China remains an exception after US President Donald Trump took two steps back from the fierce reciprocal tariffs he had announced on countries from around the world.

His announcement of a ‘90-day pause’ in tariffs for all except China came after US equities fell, the bond market shook, and financial volatility indicated worse to come.

Trump had announced huge and extensive reciprocal tariffs on all countries with his usual bluster. His manner showed the capacity to bully and attempt to shape global economics as his allies and adversaries worried about the consequences of his trade war on their economies.

However, in view of the market reaction, Trump’s friends and advisors advised a step back, even as a universal 10 percent tariff remains in place.

Trump’s boastful triumphalism and obnoxious and humiliating language, however, has laid bare US hegemony and the asymmetric relations the US enforces on every country, aligned with it or not.

China, however, refused to bend.

When Trump first put a 34 percent tariff on China (with 20 percent on the EU, 26 percent on India, and so on), China retaliated with reciprocal tariffs on US goods entering China.

It announced plans to retaliate and increased duties on US goods entering China to 84 per cent and then to 125 per cent.

A full-scale trade war between the world’s two biggest economies is now raging. And the whole world will be impacted.

Trump wants China to sue for negotiations with him but he is being ignored.

He is enraged with Chinese ‘insolence’ because all other countries have cowered. Those who had imposed reciprocal tariffs have suspended them and are hoping for negotiations.

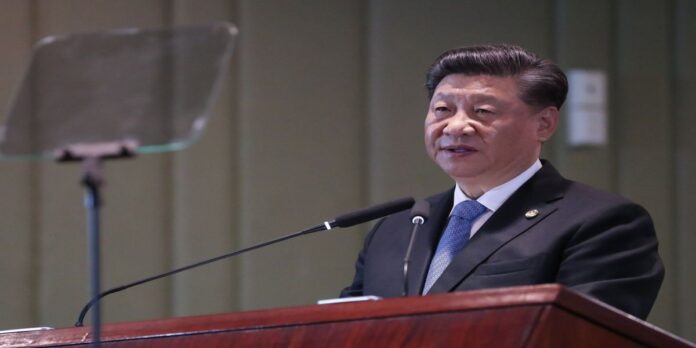

Although Trump raised reciprocal tariffs on China to punitive levels, this has failed to elicit even a phone call from Chinese president Xi Jinping.

China in fact suspended exports of certain rare earth minerals and magnets to the US, tightening the screws and demonstrating that this was a game that two can play. It has also advised its companies to refuse to take deliveries of Boeing aircraft.

Rare earth minerals are critical for the semiconductor, aerospace and car industries. China controls about 80 percent of global rare earth minerals and slightly over 90 per cent of their processing capacity.

Trump had to walk back again as he revised the rules and announced exemptions on some electronic goods from China such as smart phones, consumer electronics, and computers, which the US consumer cannot do without.

But what about other goods from China that the US depends on?

China manufactures 80 percent of the world’s room-air conditioners; three fourths of all electric fans imported by the US; 80 percent of children’s toys; and 50 percent of the ingredients that go into antibiotics.

So, will the US jump-start manufacturing overnight? The answer is obvious.

Moreover, China is the second-largest holder of US Treasury Bonds. If it divests these the US economy may sink faster than a stone in a (Chinese) cup of tea.

Meanwhile, there is much rhetoric, commentary and attempts to shape the narrative that favours the US.

Steve Miran, Chairman of the US Council of Economic Advisors argues that the whole world should pay the US for the “global public goods” it provides.

These wonderful gifts according to Miran are: first, a ‘security umbrella which has created the era of greatest peace mankind has ever known’ – ignoring the fact brought out by the Congressional Research Service showing that the US launched at least 251 military interventions between 1991 and 2022 alone.

And second, the US provides the world the benefits of the dollar, treasury securities, and strategic reserves that make the global trading system possible.

Miran’s case is that since these ‘benefits’ come at a cost to US tax payers, the US is a victim and exploited by the world.

Therefore, he suggests, all countries should come together to pay the US back through tariffs, invest and manufacture in the US, or just give the US tithes and contributions for this favour.

China stands as the major country to call out the US weaponisation of trade and ‘unilateral bullying’.

The Chinese position is that the entire Trump tariff scheme has ‘turned into a joke’ and that China “will resolutely take countermeasures and fight to the end.”

At the same time President Xi Jinping has said that there were no winners in a trade war — indicating that if Trump extended a hand at re-normalising terms of trade, China would gladly go back to business as usual.

Economic analysts argue that in this trade tiff the US will be a bigger loser. China exports far more to the US than the US does to China. The US is, therefore, much more dependent on China. China thus exercises more leverage and has ‘escalation dominance’ over the US.

China is also sending a critical geoeconomic signal with its stance – that it will resist US bullying and economic hegemonism. China has appealed to the EU and other countries, including India, that they should stand together against US tariffs.

However, China is willing to stand up to the US on behalf of the global majority. It has also criticised the US attitude of putting tariffs on poor and developing countries.

The US has managed to self-isolate and China has taken the opportunity to show its economic capacity.

China is taking the US to the World Trade Organization (WTO) for violating international trade laws put together after years of negotiations. Other countries, including the EU and India, who believe in global governance structures and rules of international trade, should join this appeal to the WTO.

China is giving a clear message: the US needs to cooperate on international trade and if it acts as the bull in a China shop, only economic grief can follow.

About author: Anuradha Chenoy is Adjunct Professor at the O.P. Jindal Global University, Sonipat, Haryana, India.

Originally published under Creative Commons by 360info™.